Our Approach

Our focus is in Malaysia, Australia, Japan, and Hong Kong – sector agnostic.

Leveraging sponsor resources and track record will be key when targeting value-add opportunities. Where we lack track record, we align and partner with experienced operators in executing asset plans pre and post acquisition.

Ensuring investments have de-risked exit strategies in place is also critical.

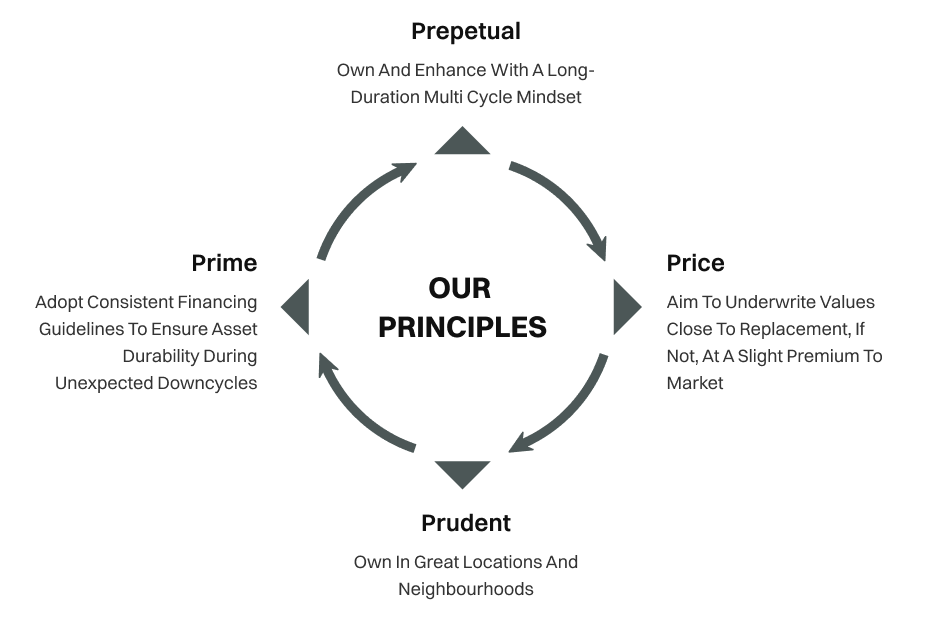

our Principles

Perpetual

Own and enhance with a long-duration multi cycle mindset

Prime

Own in great locations and neighborhoods

Price

Aim to underwrite values close to replacement, if not, at a slight premium to market.

Prudent

Adopt consistent financing guidelines to ensure asset durability during unexpected downcycles.

Strategies

Capitarea’s team offers comprehensive multi-sector, risk return and capital stack opportunities with a localized approach.

Core+

Stabilized assets in high conviction sectors with prudent leverage, income oriented, and moderate capital upside.

These are substantially stabilized assets in core locations with core+ return profiles delivered through superior origination, transaction structuring, optimal financing terms, and hands on asset management.

Key Components:

- Stabilized Income & Occupancy profile

- High Tenant & Operator quality

- High Conviction Sector

Value Add

Underperforming assets with moderate to aggressive leverage, moderate income generation and capital growth.

Key Components:

- Income, Margin & Occupancy underperformance

- Unutilized GFA

- Recapitalisation

core+

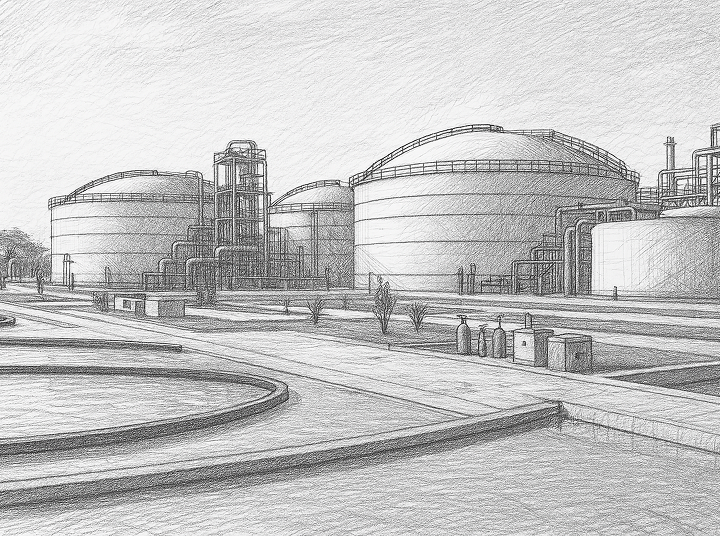

Capitarea is currently developing pipeline for Malaysian based infrastructure opportunities within the palm oil and real estate sector.

Decarbonization remains a key agenda.

Core+

Capitarea is currently developing pipeline for Malaysian based infrastructure opportunities within the palm oil and real estate sector.

Decarbonization remains a key agenda.

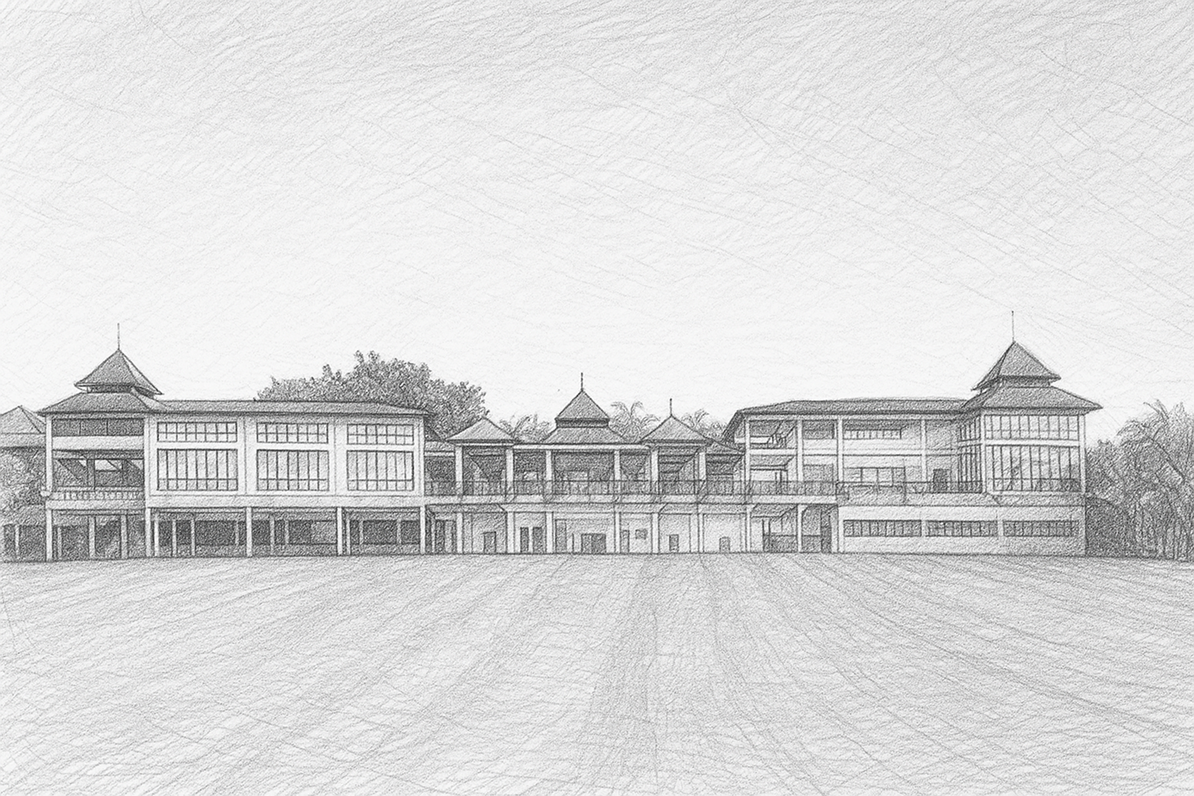

value add

Underperforming operating businesses requiring extensive asset turnaround plans via Management or Leaseback structures.

These are revenue generating business that require change management, systems streamlining, procurement optimisation and brand positioning.

These businesses also possess significant untapped underlying real estate – creating potential development opportunities for the sponsor.

Key Components:

- Golf Clubs and Accommodation Resorts

- SOP, Cost Structure, Systems, Product Pricing and Mix Strategy

Value Add

Underperforming operating businesses requiring extensive asset turnaround plans via Management or Leaseback structures.

These are revenue generating business that require change management, systems streamlining, procurement optimisation and brand positioning.

These businesses also possess significant untapped underlying real estate – creating potential development opportunities for the sponsor.

Key Components:

- Golf Clubs and Accommodation Resorts

- SOP, Cost Structure, Systems, Product Pricing and Mix Strategy